Prologue

Amid the grand theater of global capital, few narratives resound with the same symphonic gravitas as that of amd aktie—the living embodiment of Advanced Micro Devices, Inc. What began as an obscure contender in the microchip underworld now resonates alongside luminaries such as Intel and NVIDIA. AMD’s saga is a pilgrimage through innovation and resilience, a testament to tenacity wrapped in silicon and code. What unseen energy propels this relentless surge? Beneath the ticker lies an odyssey of creation, ascension, and unquenchable ambition.

The Essence of AMD

Since its inception in 1969, Advanced Micro Devices has stood as a crucible of semiconductor brilliance. It orchestrates the design and intelligence of microprocessors, GPUs, and the intricate computational sinews that drive personal computers, gaming realms, and vast data empires.

From the furnace of competition with Intel to its metamorphosis into an AI-era virtuoso, AMD’s journey is one of constant reinvention. Its trinity—Ryzen, Radeon, and EPYC—embodies a harmony of precision, velocity, and endurance, commanding reverence across technological disciplines.

AMD’s Dominion in the Market

In today’s semiconductor cosmos, amd aktie reigns as the indomitable counterpart to Intel’s CPU dominion and NVIDIA’s GPU empire. Through a fusion of daring vision and strategic prudence, the company has cultivated a formidable stronghold of influence and credibility.

Contrary to Intel’s monolithic structure, amd aktie entrusts the crafting of its silicon to distinguished artisans like TSMC. This partnership frees amd aktie to channel its intellect toward design supremacy and architectural ingenuity. What some might deem a constraint becomes a crucible of creation—liberating invention from industrial rigidity.

AMD Aktie’s Meteoric Voyage

Bearing the NASDAQ insignia AMD, the stock has risen from obscurity—once scarcely above $2 in 2015—to the lofty realm beyond $150, a resurrection whispered through the corridors of Wall Street legend.

In 2025, this ascent persists, buoyed by the proliferating tides of AI computation, cloud labyrinths, and data sovereignty. Quarterly symphonies of numbers narrate consistent crescendos in revenue, particularly within the enterprise and cloud intelligence frontier.

Forces Igniting AMD’s Ascendancy

- The Unquenchable Semiconductor Appetite

As humanity deepens its bond with digital cognition and interconnectivity, the world’s hunger for silicon intelligence becomes insatiable—and AMD thrives at this nexus of necessity and innovation. - The Gaming and AI Renaissance

At the confluence of creativity and computation, AMD flourishes. Its Ryzen and Radeon creations empower both the dreamers and the doers—artists, gamers, and architects of virtual worlds alike. - The Aftershock of the Chip Famine

While the global chip scarcity strained the industry, it simultaneously underscored AMD’s resilience. Its deft alliances with foundries preserved its rhythm when others faltered, proving that adaptability is the truest currency of progress.

AMD’s Technological Masterstrokes

AMD’s legend is etched upon three monumental innovations—each a pillar redefining digital boundaries:

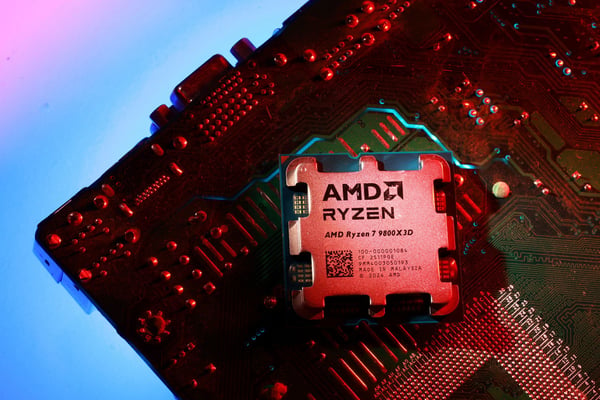

- Ryzen Processors: A masterstroke of equilibrium, fusing elite computational might with attainable pricing.

- Radeon Graphics Cards: Fearless rivals to NVIDIA’s reign, empowering visual artisans and digital combatants.

- EPYC Server Chips: The unseen titan powering data sanctuaries, AI infrastructures, and corporate cloud fortresses.

Together, these masterpieces sustain AMD’s fiscal symphony and strengthen investor faith in its technological empire.

AMD and the Age of Artificial Cognition

With audacious stride, AMD ventures into the realm of AI, wielding its MI300 accelerators as its spear—an open challenge to NVIDIA’s long-standing dominion.

Alliances with giants such as Microsoft Azure and Meta fortify AMD’s reach into the AI stratosphere, establishing it as a chief architect of tomorrow’s intelligent continuum.

Strategic Acquisitions: The Web of Expansion

AMD’s rise is interwoven with acquisitions that amplify its reach and redefine its DNA:

- Xilinx: Bestowed adaptive computing and FPGA mastery—transforming AMD’s flexibility into art.

- Pensando: Strengthened its sovereignty over data-center networking and digital defense.

These acquisitions form a lattice of resilience and versatility, a structural armor against the tremors of technological volatility.

Dividends and Fiscal Discipline

While its dividends remain subdued, AMD’s Earnings Per Share resound with disciplined progression. Rather than dispersing capital to shareholders, the company reinvests its wealth into research, innovation, and expansion—fueling its relentless pursuit of evolution. AMD exemplifies the creed of a growth-driven visionary, not a passive benefactor.

AMD Stock Forecast

Financial oracles whisper optimism. With AI’s proliferation, data’s exponential sprawl, and AMD’s steadfast innovation, its future gleams with incandescent promise.

- Short-Term: Expect ripples amidst the turbulent seas of tech volatility.

- Long-Term: The horizon stretches infinitely—AI’s golden dawn beckons.

Risks Cloaked Beneath Radiance

Every ascent invites peril. Discerning investors must navigate with vigilance:

- Market Volatility: Tech’s terrain is mercurial, its winds shifting without warning.

- Supply Chain Fragility: AMD’s reliance on TSMC introduces a shadow of vulnerability.

- Rival Resistance: Intel and NVIDIA remain relentless, fortifying their arsenals with innovation and scale.

Wisdom, therefore, lies in balancing fervor with foresight.

When to Embark on the AMD Voyage

Market timing remains an enigmatic art—part instinct, part intellect. Seasoned investors often strike during ephemeral dips—following earnings lulls or correctional waves. Monitoring AMD’s fiscal revelations, AI unveilings, and strategic conquests unveils these golden windows of entry.

Acquiring AMD Aktien: The Pathway

- Select a trusted brokerage (eToro, Interactive Brokers, Robinhood).

- Complete verification protocols.

- Locate AMD (NASDAQ: AMD).

- Determine the scale of your acquisition.

- Execute a market or limit order.

- Steward your portfolio with discernment and agility.

Investor’s Lexicon of Wisdom

- Diversify Wisely: Shield your portfolio from single-entity overexposure.

- Remain Informed: Every AMD innovation can echo through its market valuation.

- Observe Competitors: Intel’s and NVIDIA’s countermoves can redefine the chessboard.

- Analyze Earnings: Clarity in numbers is the compass of prudence.

Epilogue

To invest in AMD Aktie is not mere speculation—it is a declaration of faith in the architecture of tomorrow. Anchored in invention, armored by AI, and propelled by vision, AMD gleams as one of 2025’s most magnetic equities—a sentinel of the digital epoch.

Though volatility threads its journey, its destination gleams with transformative splendor. AMD transcends the realm of manufacturing—it is the sculptor of technological evolution, shaping the very skeleton of civilization’s digital future.

FAQs

Is AMD stock a good investment now?

Indeed. For those who blend patience with perception, AMD stands as a luminous opportunity in the age of AI and silicon renaissance.

How does AMD measure against Intel?

AMD often eclipses Intel in CPU benchmarks, offering an exceptional equilibrium between prowess and price.

What’s AMD’s trajectory in AI?

Through the MI300 series and collaborations with cloud titans, AMD is cementing its legacy as a cornerstone of AI infrastructure.

Does AMD pay dividends?

Not presently. AMD reinvests its capital toward innovation and expansion rather than dividends.

Is AMD a durable long-term investment?

Yes. Despite ephemeral turbulence, AMD’s structural integrity and adaptive brilliance render it a luminous candidate for enduring growth.

One thought on “AMD Aktie: The Vanguard Chronicle of the Modern Investor”